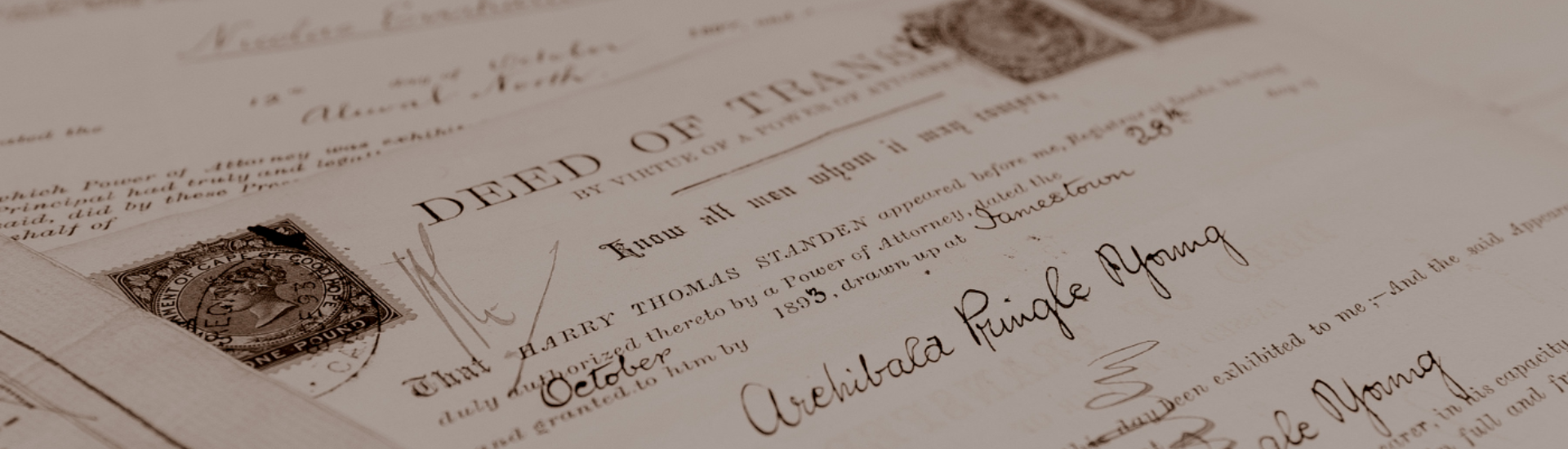

01 Nov The A-Z of Wills

A will, sometimes referred to as a testament, is a legal document that specifies how an individual wants their estate to be handled after death and how the upbringing of any minor children should be handled. If you pass away without a will, your wishes for your estate may not be honoured. Furthermore, settling your affairs after your death may require your heirs to spend more time, money, and emotional energy winding up your affairs. This article outlines the importance of drafting a will, and what should be included.

Why You Need a Will

There is a prevailing belief that wills are only necessary for wealthy people or those with complex estates. But, regardless of your circumstances, having a will is a smart idea for several reasons:

You can choose who will inherit your estate once you pass away.

The individual who will manage your estate should also be named in your will. How your possessions are shared amongst your heirs is your decision.

You can prevent someone you don’t want to own your assets from obtaining them (such as a distant relative).

You can appoint a guardian for your minor children. Courts will make decisions in the absence of a will.

It will be quicker and simpler for your heirs to access your assets.

You can make arrangements to avoid paying taxes on your estate. Giving gifts and charity contributions can reduce the estate tax.

What Should Be in a Will

Revoke every other will: Include a “revocation” provision at the beginning of your will that nullifies every other will. This guarantees that your loved ones won’t suffer from family conflicts or even legal disputes over inheritance, even in the unlikely event that another will surface after your death.

It’s crucial to include a testamentary trust clause in your will and designate trustees who will manage your minor children’s inheritance if you have any. In your will, you can name a guardian for your minor kid or children, but keep in mind that the courts have the final say and are required to act in the child’s best interests.

Your last wishes should be in your will. You can specify in this section of your will what you would like to happen to you when you pass away, such as whether you want to be buried or cremated.

Make sure your will has your signature. Your final will and testament must be signed in “wet ink,” by you and two witnesses, and cannot be signed electronically. Keep in mind that witnesses to your will might not inherit from you or be appointed as guardians, executors, or trustees.

Specify your beneficiaries and each one’s inheritance. Who gets what from your savings and assets, such as your house, investments, and money, should be specified in your will. It ought to include items that you own, like jewellery, automobiles, furniture, and photos.

Name your executor, the person in charge of executing your instructions and allocating your estate’s assets upon your passing.

How to appoint an executor

An executor of the estate must be named and usually, the person in charge of handling the estate is a spouse, an adult child, or a reliable friend or family member. You can choose joint executors, your lawyer and your spouse or partner.

An executor receives a deceased person’s property, pays off their obligations, and then distributes what’s left to the beneficiaries specified in their will, instead of going immediately to heirs or legatees. It is customary, and prudent, to name an executor in a will. It’s not necessary, though, as the Master of the Supreme Court has the authority to choose a replacement if you did not name an executor, the designated individual refuses to serve in that capacity, or the nominated individual passes away.

What are the executor’s responsibilities?

Acquire a certified copy of the original will, the death certificate, and any policy documents related to burial, insurance, etc.

Make a list of everything the deceased had.

Make sure the insurance company is informed and the policy is paid to the estate if any life insurance has the estate as a beneficiary.

Notify your creditors of your passing by placing an ad in a newspaper and the Government Gazette, and settle any unpaid bills and any legitimate claims against the estate. Pay income and estate taxes and file tax reports.

Who can assist you in drafting a will?

Legal professionals, banks, chartered accountants, boards of executors, insurance providers, trust firms, and other qualified individuals can all help. But, you can also design your own will; just make sure it follows all the necessary requirements to be recognized as a legitimate will.

Where to keep a will?

A copy of a will is not considered to be a legitimate will, therefore make sure your original signed will is stored securely with a reliable individual or organisation. It is also possible to obtain multiple signed copies of the original will and to give it to various reliable individuals for safekeeping. To guarantee that there will be an original signed copy available following your passing, each should maintain a copy. To avoid difficulties for your family and heirs after your death, let them know where and/or who is retaining a copy of your will.

What Happens if I Don’t Have a Will?

Should you pass away intestate, meaning without a will, you lose the opportunity to decide who benefits from your estate. Your inheritance is instead split in accordance with the law of intestate succession. To oversee the rights of your minor children and/or beneficiaries who are mentally challenged or disabled, the Master of the High Court selects an executor to manage your estate and may also need to select a curator or tutor.

An estate’s distribution formula is outlined in the Intestate Succession Act (Act 81 of 1987). According to the Act, your spouse, children (including adopted children), or any blood relations in the event that you are childless, must get half of your fortune from the executor chosen by the Master of the High Court.

Even though you can write a will on your own, you are strongly advised to get legal advice. A knowledgeable lawyer can make sure your will satisfies all legal criteria and is valid legally. They can also offer advice on complicated matters like asset protection and tax planning. A lawyer can also assist in averting future legal problems amongst your beneficiaries or heirs following your passing.

Kindly be advised that AWD Law does not enter into litigation on behalf of clients. Our conveyancers specialise exclusively in the development of vacant land, property transfers, bond registrations, administration of deceased estates and notarial practice. Should you require assistance with a litigation, kindly contact The Legal Practice Council.

Contact AWD Law For Professional Property Advice before signing your Offer to Purchase.

All fields marked by an asterisk are required for form submission.