29 Jan Conveyancer’s Fees Explained

Once you have managed to find your dream home, you will need to use the services of a conveyancer to have the property transferred into your name. The conveyancer will charge you fees for their service, to ensure a seamless and compliant process. So how much are conveyancer’s fees and what services do they cover?

What is Conveyancing?

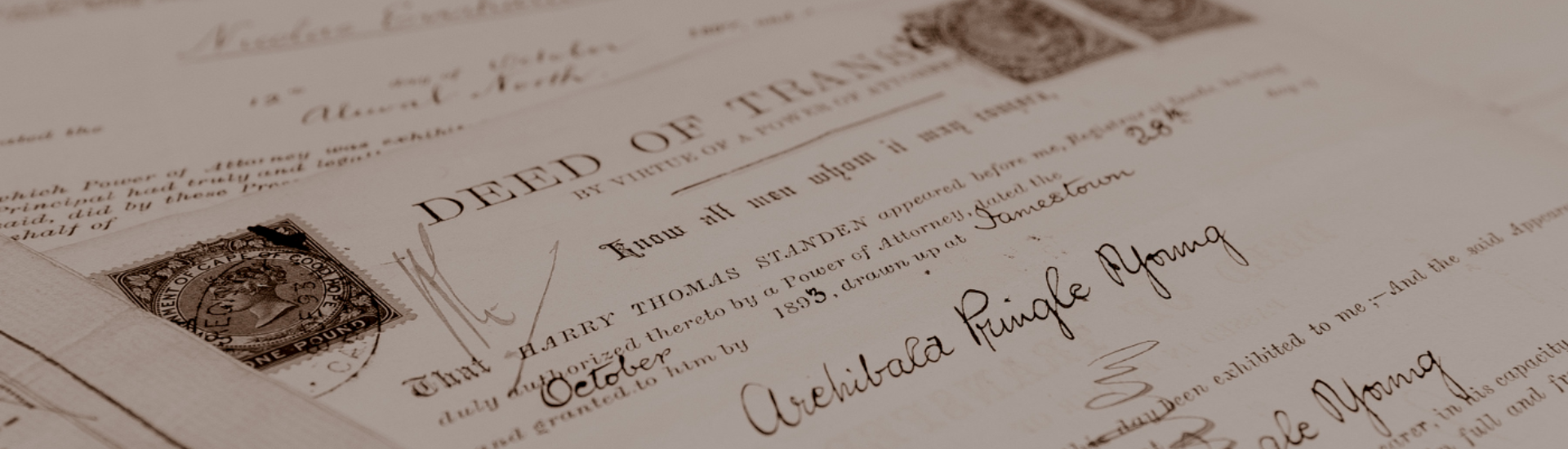

Conveyancing is the process of transferring the legal ownership of a property. It transfers (conveys) property from one natural person or entity to another. The process must be followed in stages.

Why are Conveyancing Fees Charged?

Conveyancing fees cover the conveyancer’s time and skill when attending to a property transfer. This includes the time needed to prepare all the necessary paperwork and perform due diligence.

Due diligence means ensuring the property’s title is free of any conflicts. The purchaser’s attorney performs due diligence searches. The conveyancer corresponds with attorneys and banks when passing of transfer to ensure all outstanding rates, taxes and services are paid to all relevant authorities, as well as levies payable to Home Owners’ Associations and Body Corporates.

In the conveyancing process, the conveyancer will pay all taxes and fees for the property transfer. These fees consist of, inter alia, professional fees rates and taxes. The conveyancing attorney will pay these taxes and fees on time. This is to protect you from delays and potential fines.

A conveyancing attorney will charge fees for each service they perform, including

- Requesting cancellation figures

- Orchestrating simultaneous lodgment with other attorneys, which will eventually lead to registration of transfer

- Preparing relevant documentation

- Applying for rates clearance

- Conducting Deeds searches against subject properties and sellers thereof

- Applying for levies payable to Home Owners’ Association and Body Corporates, if applicable.

How much are Conveyancer’s Fees?

Of course, clients all want to know how much conveyancing fees cost. There is no single, fixed cost because properties incur different conveyancing fees. This is because there are differences in, inter alia, paperwork and administrative fees, zoning, and local authorities. Ultimately, your conveyancing fee is determined by several factors including:

- The value or sale price of the property. The conveyancer’s fees are typically calculated on a scale relative to the sale price of the property in question.

- The type of property being sold. Conventional title deeds and sectional title deeds may attract different fees.

Would you like an estimate of the conveyancer’s fees for your property transaction? We have created a bond and transfer cost calculator to help you budget. You can use it here. If you have any queries about your property transaction, please feel free to contact our Senior Conveyancer, Andre Germishuizen andre@awdlaw.co.za

Tips When Dealing Conveyancers and Conveyancing Fees

It’s important that you understand all the fees and expenses of transferring property so you can budget accurately. A qualified and experienced conveyancer should explain all the fees and costs to you before you enter into a property transaction. We always recommend that our clients seek professional property advice as soon as they are thinking of purchasing or selling their property.

You must be organised and responsive so you can avoid delays and possible additional fees. Give the conveyancing attorney all the requested paperwork and information. In this way, you can complete the process efficiently.

- Conveyancing fees are paid in advance of the registration of property transfer or mortgage bond, if applicable

- They are charged to cover the cost of general conveyancing duties associated with a property transaction to ensure a smooth and compliant property transaction.

FREQUENTLY ASKED QUESTIONS

About Conveyancer’s Fees

How much can a conveyancer charge?

The Legal Practice Council provides recommended guidelines for conveyancing fees.

Who appoints the conveyancer in a property transaction?

Usually, a conveyancer is appointed by the seller or the seller’s bank.

Who is responsible for paying conveyancing fees?

The purchaser is responsible for paying the conveyancer fees even though the conveyancing attorney is typically appointed by the seller.

What is a disbursement?

Disbursements are third-party costs (i.e. to the Deeds Office or local authorities).