09 Jun Renting vs Buying a Home:

What’s Best For You?

For many people, buying a home is the dream, however with the current interest rate hikes, some might think renting is better.

The national vacancy rate, or the number of vacant properties, decreased from 11.71% in Q4 2021 to 8.13% in Q4 2022, according to the most recent TPN Vacancy Survey.

According to a survey done in 2022, the majority of tenants of all ages rent because they simply cannot afford to buy, with 54% of respondents citing affordability as their top reason for not buying a home.

Deciding whether to buy or rent is a significant choice that impacts your financial situation, way of life, and personal objectives. Depending on your lifestyle and financial position, you can select either of the options.

Pros And Cons Of Renting Vs Owning A Home

Which One is Best For You?

There Are No Upkeep or Repair Costs With Renting

The absence of most of the maintenance and repair expenses is one advantage of renting a home when compared to owning one. This means that when you rent a property, the majority of cost of upkeep, improvements, and repairs is assumed by the landlord, who is the home owner. You should contact your landlord, who is obligated to repair or replace those items as specified per agreement,

On the other hand, when you own the property, all costs associated with home maintenance and renovations are the responsibility of the homeowner. It can become expensive depending on the nature of the work required (and whether additional jobs arise at the same time), however making these home improvements can add to the value of the property.

Access to Amenities

Renters can also save money by having access to amenities that would otherwise be quite expensive. Nowadays many apartment buildings include luxuries like indoor pools, communal entertainment areas, or fitness centres as standard features at no extra cost to renters.

These luxuries could cost a homeowner hundreds of thousands of rands to install and maintain if they wanted to use them, but again, the advantage is the value these add to your property investment.

Home Owners Earn Equity

As we have indicated above, any appreciation in property value (equity) belongs to the home owner. Most homes increase in value over time however, just like any other investment, the value can also decrease. When you sell your property, you can cash in that equity as profit. However you don’t have to wait until you sell to take advantage of equity. You can borrow on the equity you have accumulated through a variety of loan options including a home equity loan or refinancing your home loan.

As a renter you don’t earn or lose equity because you do not own the home or apartment that you live in. Equity, or the increase in value a home receives over time, only belongs to the person who owns the property.

Renters Have the Flexibility to Downsize

At the end of their lease, renters have the choice to downsize to less expensive rentals. This kind of flexibility can be more beneficial for retirees who want a less expensive, more affordable space.

Due to the costs associated with purchasing and selling a home, it is considerably more difficult to leave an expensive home. Additionally, if a homeowner has spent a lot of money on improvements or renovations, the sale price may not be enough to cover these expenses, making it challenging for them to afford to sell and move.

In conclusion, renters do not have the same obligations as owners do. Both the expenses and the benefits differ. Different people have different requirements, ambitions, and lifestyles.

These variations generally influence the decision to rent or buy, and sometimes they indicate the rationale behind that decision.

The first steps in purchasing a property are:

Make sure to look into as many properties as you can and conduct extensive research.

For transfer, conveyancing, and registration charges, set aside a lump sum of money.

Make sure you keep a good credit history .

Shop around for the best bond interest rate and products at several lending institutions.

Make a thorough budget while sitting down with your financial planner.

To learn about the kind of bond and transfer costs associated with home ownership, please use our Bond & Transfer Cost calculator.

Thinking of buying a home?

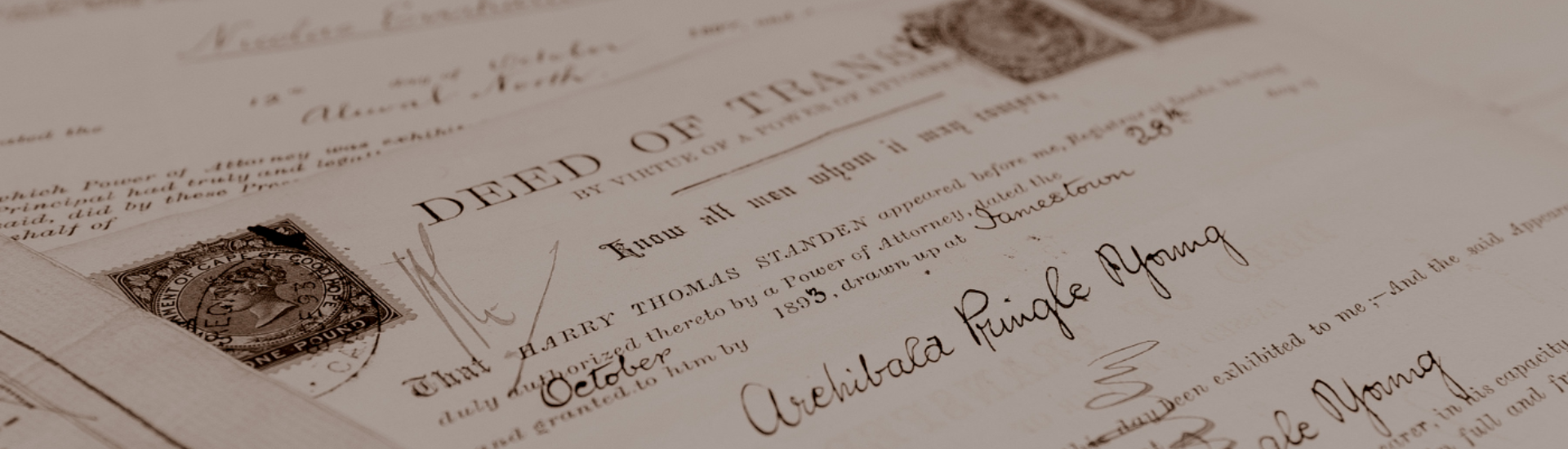

First-time home buyers may find it intimidating, but the team at AWD Law can help by providing professional property advice for your financial future. AWD Law conveyancers offer dedication, speed, efficiency, professionalism and excellent communications as part of our conveyancing service. We partner with our clients and other property professionals involved in the conveyancing and property industry, like the estate agents, bond attorneys, bond originators and others. Contact us for professional property advice.

Kindly be advised that AWD Law does not enter into litigation on behalf of clients. Our conveyancers specialise exclusively in the development of vacant land, property transfers, bond registrations, administration of deceased estates and notarial practice. Should you require assistance with a litigation, kindly contact The Legal Practice Council.

Contact AWD Law For Professional Property Advice before signing your Offer to Purchase.

All fields marked by an asterisk are required for form submission.