26 Aug The Pros and Cons of Property Co-Ownership

Co-ownership of property is a great way to get onto the property ladder as owners can share costs and responsibilities. While many people want to invest in real estate, not everyone can afford to purchase a home, apartment, or land. However, entering into co-ownership requires careful consideration and due diligence because it can be challenging to jointly own property with friends, siblings, or other family members. This article will outline some critical aspects of co-ownership of property in South Africa.

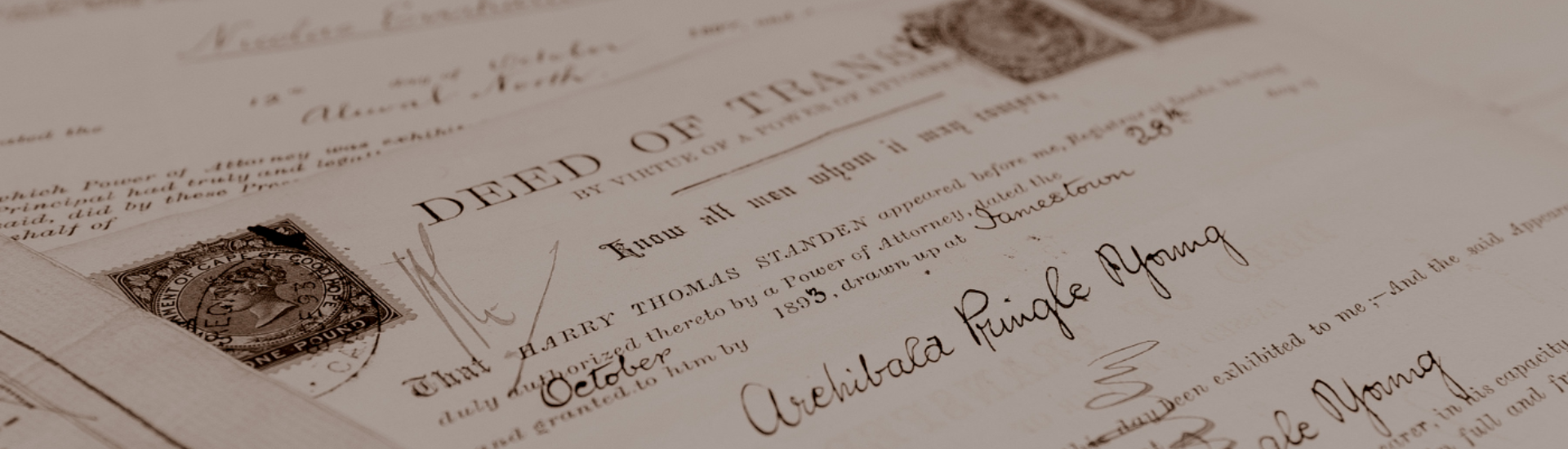

What Is Property Co-ownership?

Co-ownership of property refers to the ownership of a piece of land or property by two or more natural persons. This covers the entire property and any dwelling on it.

For instance, a single individual cannot own a specific part of a property exclusively. All involved parties collectively own the land. However, it is possible to own a larger or smaller share of the property. For example, one owner might possess 70% of the property while another owns 30%. Consequently, one owner pays 70% of the bond, and the other pays the remaining 30%. If the bond is sold, the profit will be distributed in the same proportion.

In South Africa, co-ownership of real estate is regulated by a mix of common law rules and legislative measures, including the Prevention of Illegal Eviction and Unlawful Occupation of Land Act 19 of 1998, the National Credit Act 34 of 2005, and the Deeds Registries Act 47 of 1937.

What To Keep In Mind When Considering Property Co-ownership

If you are considering property co-ownership, a legal contract between the parties is essential. This is a binding document for your co-ownership arrangement, and it protects each party’s rights.

Make sure you have done your due diligence in respect of the person you wish to enter into a property co-ownership agreement with. Ascertain their dependability by making sure they will help with upkeep and maintenance, and generally be a pleasant person to own a property with.

Conflicts can sometimes be unavoidable and can significantly damage your relationships if left unresolved. It is important to ensure that the partnership agreement includes a dispute resolution clause to safeguard the property co-ownership agreement you are entering into.

The Advantages of Property Co-ownership

There can be many benefits to co-owning property, some of the benefits include:

Equitable Financial Load

The ability to divide the costs of buying and maintaining property is one of the key advantages of co-ownership. When co-owners pool their resources, property ownership becomes more practical and cost-effective.

An Increase in Purchasing Power

Individuals can invest in larger and possibly more valuable properties than they could afford alone when they co-own a property.

Shared Investment Risk

It can be comforting to know that the risk of the investment is shared, especially if it’s your first property purchase. This can build your confidence to make the next purchase less stressful.

The Disadvantages of Property Co-ownership

Unfortunately, co-ownership can also come with risks. It is financially wise to educate yourself about the potential risks before formalising a property co-ownership agreement:

Fallouts or Disagreements Among Investors

Life will inevitably involve disputes and fallouts, and property investment is not immune to differences of opinion. Your legal agreement should detail a dispute resolution process to safeguard all parties in the event of a fallout.

If selling the property is the desired course of action, all parties should consent to it and bear equal responsibility for the associated costs and expenses. Without all co-owners permission, one party cannot just sell the house.

All parties involved may be directly impacted by the decisions and actions of co-owners. The other investors may face difficulties if a co-owner chooses to sell their stake or neglects to fulfil their obligations.

When one person’s finances may not allow for home ownership,

Kindly be advised that AWD Law does not enter into litigation on behalf of clients. Our conveyancers specialise exclusively in the development of vacant land, property transfers, bond registrations, administration of deceased estates and notarial practice. Should you require assistance with a litigation, kindly contact The Legal Practice Council.

Contact AWD Law For Professional Property Advice before signing your Offer to Purchase.

All fields marked by an asterisk are required for form submission.