01 Aug Step-by-Step Guide to Conducting Due Diligence Before Buying Property in South Africa

Buying property in South Africa is a major milestone, one that involves a substantial financial and emotional investment. Whether you’re a first-time buyer or an experienced investor, conducting thorough due diligence is critical to avoid costly surprises and ensure a smooth transfer process. In South Africa, where legal, financial, and regulatory complexities abound, due diligence protects buyers from fraud and future disputes.

In this article, we provide a practical, step-by-step guide to conducting due diligence before buying property in South Africa, supported by local stats and legal context.

Why Due Diligence Matters Before Buying Property In South Africa

According to Lightstone Property, South Africa recorded over 235,000 residential property transfers in 2023, with a total value exceeding R500 billion. Yet, not every transaction goes according to plan. Disputes over ownership, land use restrictions, or hidden debt attached to a property are not uncommon.

The Office of the Ombud for Community Schemes (CSOS) reports a steady rise in complaints, particularly in sectional title schemes, which highlights the need for deeper scrutiny before signing an offer to purchase.

Step 1: Check the Seller’s Legitimacy Before Buying Property In South Africa

Before proceeding with an Offer to Purchase, ensure the seller is the rightful owner of the property. This is a basic but essential step that prevents fraudulent sales.

How to:

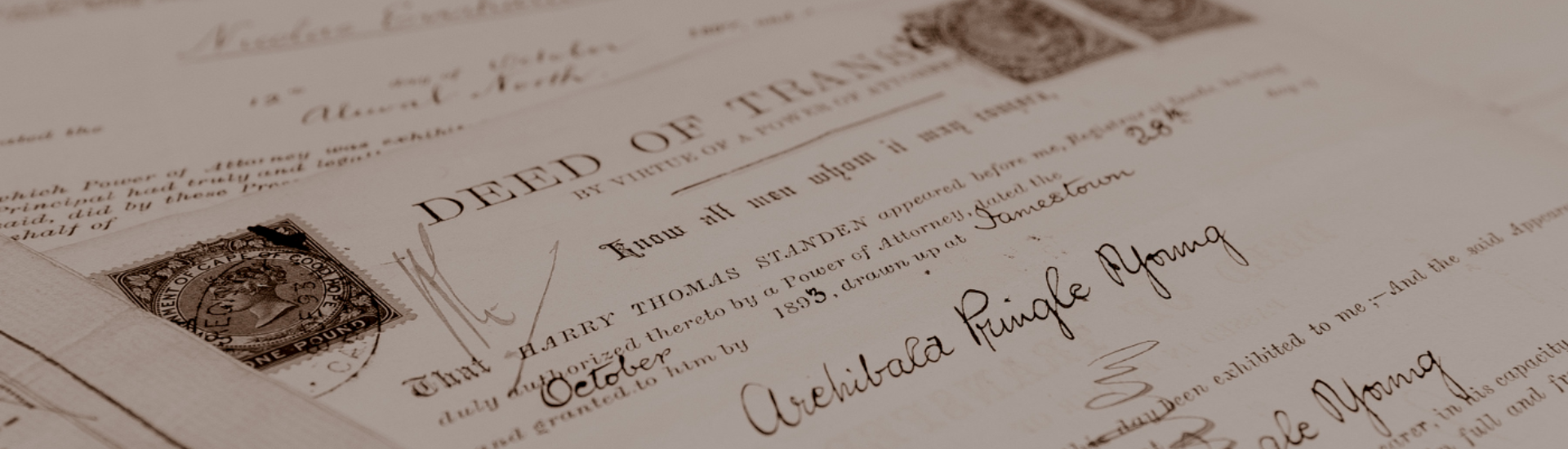

Request a Deed of Transfer from the seller, or ask your conveyancer to retrieve it from the Deeds Office.

Cross-check the ID and full name of the seller with the title deed.

Tip: If a company or trust owns the property, verify the registration documents and the authority of the signatory.

Step 2: Obtain a Copy of the Title Deed

The title deed contains valuable information such as

- The owner’s name

- Restrictions or conditions (e.g., servitudes, reversionary clauses)

- Mortgage bonds registered over the property

- If the property has a restrictive condition, it could impact your intended use.

Where to get it:

Your conveyancer can pull the latest title deed from the Deeds Registry.

You may also use DeedsWeb (government site) or third-party services like Windeed or Lexis PropIQ.

Step 3: Verify the Zoning and Land Use Rights

Zoning dictates how a property can legally be used: residential, agricultural, commercial, or mixed-use.

Why it matters:

If you’re planning to run a business or develop the land, make sure the zoning permits this. Rezoning applications can take months and are not guaranteed.

How to:

Contact the local municipality’s planning department for a zoning certificate.

Check the Spatial Development Framework (SDF) to see future development plans in the area.

Step 4: Conduct a Municipal Clearance Check

Sellers must provide a municipal clearance certificate before transfer, proving that all rates, electricity, water, and refuse accounts are fully paid.

But as a buyer, you can also request the latest municipal account to:

- Verify arrears or irregular billing

- Ensure that no Section 118(3) debt (which can attach to the property) is outstanding

Section 118(3) of the Municipal Systems Act allows municipalities to recover historical debt attached to the property, even from new owners in some interpretations.

Step 5: Inspect for Compliance Certificates

Some compliance certificates are required by law before transfer, while others are recommended to avoid future problems.

Required Certificates:

- Electrical Compliance Certificate (COC), valid for 2 years.

- Beetle Certificate, mandatory in coastal provinces (KwaZulu-Natal, Western Cape, Eastern Cape).

- Water Installation Certificate, required in Cape Town.

Recommended:

- Gas compliance (if applicable)

- Electric fence compliance (for sectional title or estates)

- Building plans approval from the municipality

Step 6: Inspect for Illegal Structures or Building Plan Approval

Many South African homes have unapproved extensions, rooms, or carports. This can cause problems with insurance, mortgage financing, and resale.

What to check:

- Obtain approved building plans from the municipality.

- Compare them with the physical structure.

- Ensure there’s no ongoing land use enforcement action or penalty.

Step 7: Financial Due Diligence

For the Buyer:

- Get pre-approved by your bank or home loan provider.

- Understand all hidden costs: transfer duty, attorney fees, bond registration costs, and municipal deposits.

For the Property:

- Confirm the existence of any mortgage bond and the outstanding amount (you won’t inherit it, but it impacts the transfer process).

- Ask whether the property is in a Sectional Title Scheme or Homeowners’ Association (HOA), as this affects levies and restrictions.

Step 8: Review the Offer to Purchase (OTP) Carefully

An OTP is legally binding once signed. Many buyers rush into signing without a proper review.

Key clauses to understand:

- Suspensive conditions (e.g., “subject to bond approval”)

- Occupational rent terms if you move in before the transfer

- Voetstoots clause, common in South Africa, means “as is,” limiting your rights to claim for defects unless hidden fraudulently

- Consider having your attorney review the OTP before signing, this protects your interests and can flag risky terms.

Step 9: Survey the Surrounding Area

This is often overlooked but equally important:

- Crime statistics (check with SAPS or the neighborhood watch)

- School zoning

- Public transport and access roads

- Upcoming developments that may affect the value (check with the municipality)

According to Property24, location-related factors influence over 60% of buyer decisions, but many only investigate after signing.

Step 10: Work with a Reputable Conveyancer When Buying Property In South Africa

Your choice of conveyancing attorney can make or break the transaction.

A conveyancer will:

- Conduct title deed searches

- Draft and lodge transfer documents

- Liaise with SARS for Transfer Duty Receipts

- Facilitate communication with the Deeds Office

In South Africa, the seller typically appoints the conveyancer, but as a buyer, you can request a legal review.

Conclusion

Due diligence before buying property in South Africa is not just a box-ticking exercise, it’s your front-line defense against financial loss, legal disputes, and buyer’s remorse. South Africa’s property laws provide tools for transparency, but the onus is on the buyer to investigate before committing.

By following this step-by-step guide and partnering with a knowledgeable legal advisor, you can approach your property purchase with confidence and clarity.

Need Help Buying Property In South Africa?

AWD Law specialises in property law, conveyancing, and real estate disputes. If you’re looking to buy property and want peace of mind, contact us for a free consultation.

Kindly be advised that AWD Law does not enter into litigation on behalf of clients. Our conveyancers specialise exclusively in the development of vacant land, property transfers, bond registrations, administration of deceased estates and notarial practice. Should you require assistance with a litigation, kindly contact The Legal Practice Council.

Contact AWD Law For Professional Property Advice before signing your Offer to Purchase.

All fields marked by an asterisk are required for form submission.