11 Aug First-Time Home Buyers – Top Tips

Owning a home is a significant life achievement. It gives you the opportunity to transform a house into a genuine home, according to your preferences. Additionally, it is a critical step in building a stable financial future for you and your kids. The fact that it’s one of your biggest financial investments can make the experience stressful and overwhelming. It doesn’t have to be overwhelming if you stick to a few top tips for first-time homebuyers so we have put our top tips together to guide you through the process.

Many first-time home buyers are unprepared and this can lead to disappointment. You should consider whether purchasing a property is truly right for your stage of life and future plans. Ask yourself:

- What inspired you to choose to buy a home?

- What plans do you have for the next five to ten years?

You will be able to make an informed choice if you consider all aspects of this significant purchase. Here are some of the most important aspects to consider:

Analyse Your Affordability

First things first, take a close look at your budget and available funds. How much could you spend on a home? It’s not just the bond repayment you need to keep in mind. Factor in the costs of paying utilities, rates, taxes, and levies, if applicable.

Get Pre-Approval

Pre-qualification is a smart move when you want to buy a property. You will find out exactly how much you will be able to borrow and therefore, how much you can afford. Knowing your purchase power can help to guide your property search and keep you from unnecessary disappointments that come with spending beyond the limits of your budget.

In addition, pre-approval letters demonstrate to house sellers and real estate agents that you are a serious buyer, which might give you an advantage over other buyers who haven’t gone through this process yet.

Understand All Costs

Find out what other monthly expenses homeowners have in addition to their bond repayments. Conduct online research, speak to other people and learn about the costs and taxes relevant to place you want to relocate to.

Make sure you are informed of all the extra expenses related to purchasing a home, such as transfer fees and bond registration fees.

You have the right to request the financial accounts if you’re buying in a sectional title complex to make sure the Sectional Title Scheme is well-maintained and in a sound financial shape. Inquire as well about any additional fees.

Manage Your Money

The first thing you should do is control your expenditure and savings. Financial institutions would, amongst others, request bank statements to verify your ability to repay a loan. You must demonstrate your affordability.

Your bank statements should show:

- Regular deposits of income that should correspond with the information as provided on your application for a mortgage loan

- A monthly surplus after expenses

- No unarranged overdraft fees or bounced automatic payments or debit orders

First-time home buyers should be aware of how much they spend on their day-to-day expenses and differentiate between “must-haves” and “like-to-haves”.

Know Your Credit Score

Credit score falls between 300 and 850 in South Africa. Anything over 700 is generally seen as good. Your credit profile and credit score are both taken into account when applying for a home loan, because a credit report demonstrates to the bank how you have previously handled debt. The process of buying a property begins way before you even think of it.

Did you know that consumers are entitled to one free credit report check every 12 months under the National Credit Act? Take advantage of this now.

Know What You Are Buying

In your search for the ideal home, you will view a lot of houses. Understand how to look past the decor. Do the plaster or walls exhibit any dampness, and are there any structural cracks? The roof may be sagging. Before you submit your Offer to Purchase, think about hiring a home inspection company to evaluate the property. Home inspectors look for risks such as:

- Structural damage

- Water Leaks and damp areas

- Faulty gas, plumbing, and electrical installations

- Rotten wood

- Hazardous substances (including asbestos, lead-based paint, and moulds that are toxic)

Repay More Than You Need To On The Home Loan

Even though a home loan is a long-term commitment and may be the largest debt you ever incur, you can pay it off far more quickly by making extra deposits each month. It requires strict adherence to your monthly budget, but once you do, the rewards come quickly. Increase your monthly home loan repayment contribution if you receive a salary boost at work. Instead of putting your bonus and tax refunds toward reckless purchases, put them toward your bond.

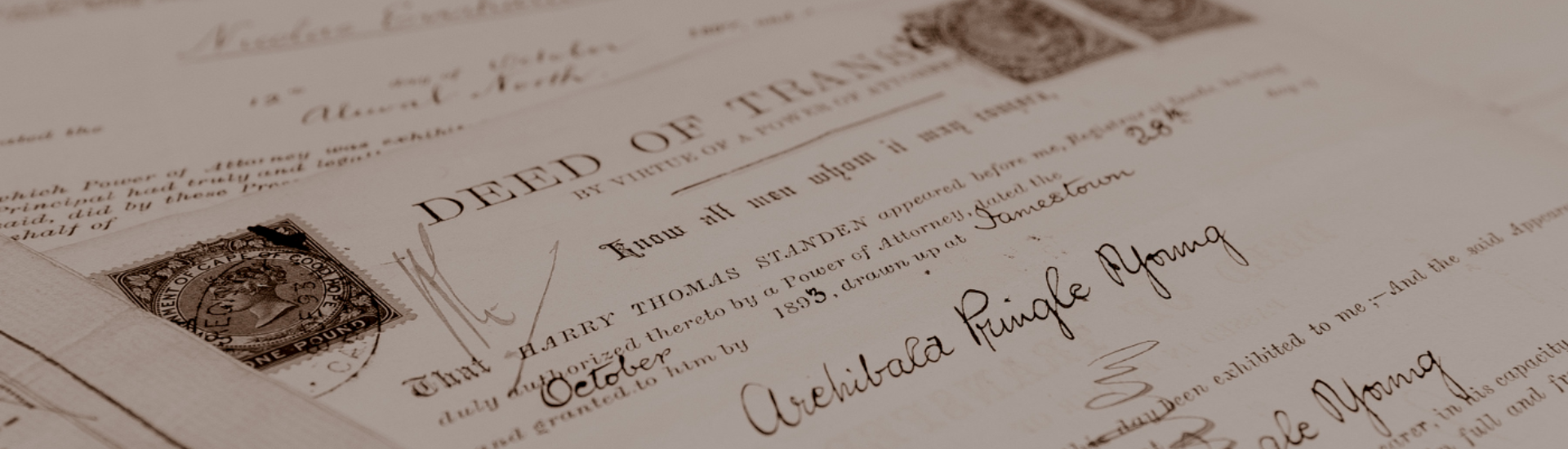

Get A Good Conveyancing Attorney

Last but not least, get yourself an experienced conveyancing attorney. Conveyancing attorneys should be consulted before submitting (or signing) an Offer to Purchase. AWD Law guides you through the conveyancing process, ensuring you are informed & compliant.

When you work with AWD Law you are in the capable hands of a professional and experienced conveyancer in Pretoria, at the forefront of South Africa property laws and guidelines.

Contact Andre for professional property advice: andre@awdlaw.co.za

Kindly be advised that AWD Law does not enter into litigation on behalf of clients. Our conveyancers specialise exclusively in the development of vacant land, property transfers, bond registrations, administration of deceased estates and notarial practice. Should you require assistance with a litigation, kindly contact The Legal Practice Council.

Contact AWD Law For Professional Property Advice before signing your Offer to Purchase.

All fields marked by an asterisk are required for form submission.