27 May How deposits work for first-time buyers

In recent years, banks have aimed to assist first-time buyers in entering the home owners market by offering them 100% home loans, eliminating the need for a deposit. While this can expedite the home-buying process, it results in higher interest rates, increased monthly repayments, and a larger total loan repayment over 20 years. However, if a deposit is made, these expenses can be minimised, providing the buyer with some relief.

As a first-time home buyer, putting down a deposit when buying a house or property has various benefits. Let’s explore how you could benefit from this.

The benefits of putting down a deposit for first-time buyers

A Sign of Commitment

When you sign an agreement to buy a new house, putting down a deposit is a sign of commitment and goodwill. Some sellers may require a deposit, which should be included in the Offer to Purchase. This gives the seller assurance that the buyer is sincere and has the funds to complete the transaction. Compared to offers from other potential purchasers without a deposit, the seller is more likely to accept an offer with one.

Better Interest Rates and Low Monthly Repayments

Making a deposit can improve your chances of securing a home loan from the bank at a favourable interest rate and reduce your monthly mortgage payments. You can use our bond calculator to estimate how much you could save by making a deposit. It’s recommended to make a larger deposit if possible, as a higher deposit leads to lower mortgage payments since you’ll owe less to the bank.

You Have Less to Repay if you Borrow Less

When a deposit is paid, the total value or size of the home loan is essentially decreased. This means that, compared to a buyer who did not pay a deposit, the buyer will be repaying a considerably smaller loan amount after the 20- or 30-year term.

Higher Chance Of Getting Your Bond Approved

Adding a deposit can increase your chances of getting approved for a home loan because it makes you less of a risk to the lender, which is the financial institution. When buying a home, you usually need to pay 10% to 20% of the purchase price upfront. If you can afford that amount or more, it shows that you may not have issues with repayments in the future. Additionally, putting down a deposit means that the gross household income required by the banks will also be much less.

Home buyers who save a deposit are better equipped to handle any upcoming financial challenges. For example, a buyer with a 100% home loan may easily find themselves in more debt if they were to lose their job, fail to pay the bond, and have to sell quickly. This is because there would be selling expenses and an agent’s commission to pay, in addition to the 100% loan balance to pay back to the bank.

The buyer who has paid a 10% or 20% deposit would be better equipped to handle the same situation. They would also be in a better position to manage any future rate increases or even pay off their home more quickly if interest rates were to fall.

Who do you pay the deposit to, and how is it managed?

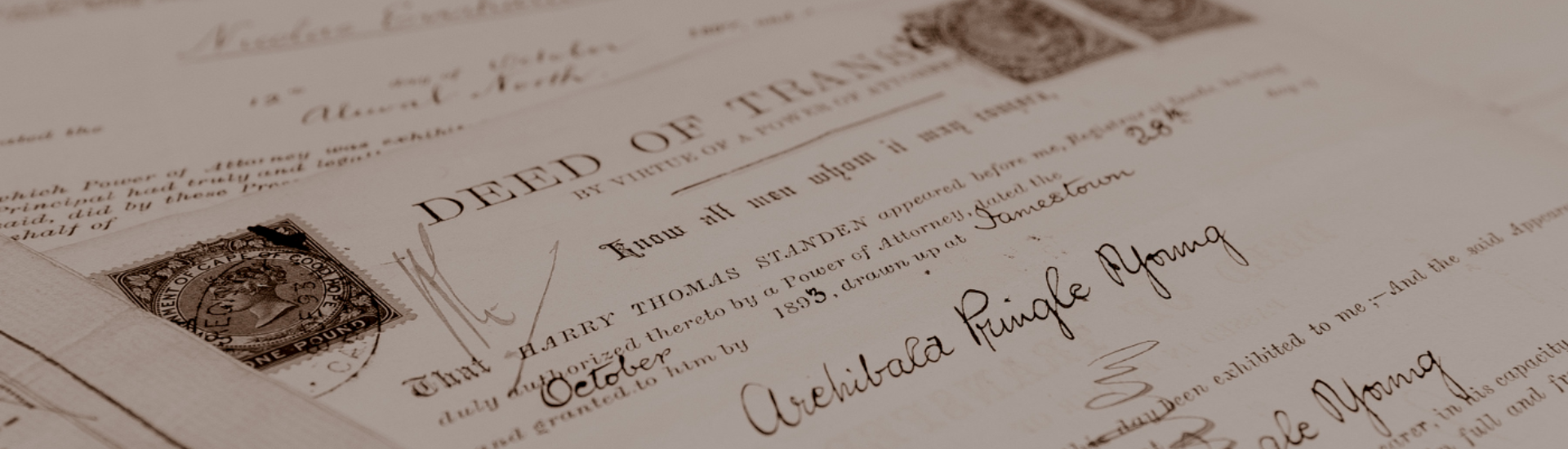

The attorney handling the transfer will receive the deposit instead of the seller and will place it in a trust account. The deposit will be safeguarded there until the property transfer and registration are completed. After the property is registered, you will receive the interest earned by the deposit.

There are multiple potential scenarios regarding the fate of your deposit. If your Offer to Purchase was conditional on the approval of your home loan and for any reason your bond was denied, your deposit will be returned to you.

In short, a deposit will provide the following benefits:

- Improve your affordability and increase the likelihood of bond approval

- Give you leverage when negotiating a more favourable interest rate (due to reduced risk for the bank)

- Minimise the interest you’ll pay throughout the loan

- Reduce your monthly bond repayments

- Enhance your attractiveness to sellers

- Improve your negotiating power

For professional property advice, please contact us

Kindly be advised that AWD Law does not enter into litigation on behalf of clients. Our conveyancers specialise exclusively in the development of vacant land, property transfers, bond registrations, administration of deceased estates and notarial practice. Should you require assistance with a litigation, kindly contact The Legal Practice Council.

Contact AWD Law For Professional Property Advice before signing your Offer to Purchase.

All fields marked by an asterisk are required for form submission.