01 Aug Common Pitfalls in South African Sale Agreements – and How to Avoid Them

Property Sale Agreements In South Africa

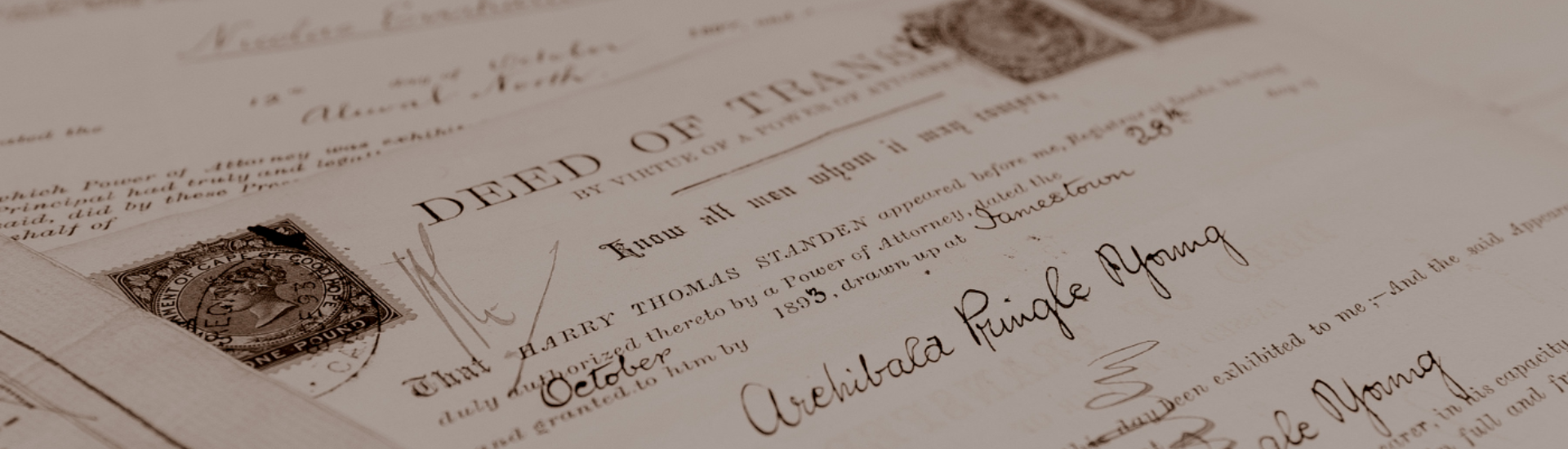

Buying or selling property in South Africa is one of the most significant financial decisions one can make. According to Lightstone and Deeds Office data, the volume of residential property transfers in 2023 dropped to about 276,793, close to the levels during the COVID-induced slump in 2020 (266,639) However, the total value of those transfers still reached roughly R241 billion, compared to R345 billion in 2022.

Meanwhile, the total stock value of South African residential property stood at R6.8 trillion as of August 2023, with some estimates putting it at R6.91 trillion by December 2023.

However, not every transaction concludes smoothly. Some deals fall apart or lead to lengthy legal disputes because of poorly drafted or misunderstood property sale agreements.

Whether you’re a first-time buyer or a seasoned investor, understanding the common pitfalls in South African property sale agreements can save you time, money, and stress. In this article, we explore some of the most frequent problems in sale agreements and how to avoid them.

Vague or Incomplete Property Descriptions During Property Sale Agreements

The Pitfall:

A property sale agreement must describe the property being sold accurately. However, disputes can arise because of vague or incorrect descriptions, particularly in sectional title schemes or agricultural land.

Common Issues:

- No reference to the correct erf or sectional title number

- Confusion between exclusive use areas and communal property

- Boundary discrepancies

How to Avoid Them:

- Ensure the property is described using the exact wording in the title deed

- Attach diagrams or plans, especially for sectional titles and subdivisions

- Cross-check with the Deeds Office if in doubt

Unclear Conditions of Sale (Suspensive Clauses)

The Pitfall:

Suspensive conditions are terms that must be fulfilled for the sale to proceed, like obtaining bond finance or selling another property first. If they are not clearly defined or tracked, suspensive clauses can cause the deal to collapse.

Common Issues:

- No deadline specified for fulfilling conditions

- No clarity on what happens if conditions aren’t met

- Parties proceed without formal confirmation

How to Avoid Them:

- Include specific deadlines (e.g., “within 30 days from signature”)

- Make provision for extensions by mutual agreement

- State clearly whether the agreement lapses or continues if the condition is not met

Failure to Disclose Defects or Encumbrances During Property Sale Agreements

The Pitfall:

South African law distinguishes between patent defects (visible) and latent defects (hidden). Sellers are not required to disclose patent defects, but latent defects must be declared, especially since the Consumer Protection Act (CPA) may apply in certain cases.

Common Issues:

- Undisclosed structural issues, leaks, or damp

- Properties sold “voetstoots” without proper explanation

- Ongoing municipal disputes or illegal building extensions

How to Avoid Them:

- Always request a full property disclosure document.

- Insist on a professional inspection before signing

- If selling, disclose all known defects in writing, even if selling voetstoots

Ambiguity Around Occupation and Possession

The Pitfall:

Confusion about the date of occupation and who pays for costs like rates and levies can lead to disputes and even eviction action.

Common Issues:

- Buyer assumes they can occupy immediately after signature

- No rental/occupational rent clause

- No mention of transfer delays and liability

How to Avoid Them:

- Define the occupation date clearly in the agreement

- Include occupational rent terms (amount, payment dates

- Specify who pays for rates, levies, and insurance between occupation and transfer

Neglecting Bond Clauses and Finance Approval

The Pitfall:

Many South African buyers rely on bank financing. If the agreement doesn’t provide adequate protection or flexibility around bond approval, buyers risk losing deposits or facing legal claims.

Common Issues:

- No clause allowing withdrawal if the bond is denied

- Missing terms about the bond amount or the deadline

- Buyers not applying “in good faith” to banks

How to Avoid Then:

- Include a suspensive condition for bond approval with a reasonable deadline

- State the minimum bond amount required

- Require proof of application and approval or denial from a financial institution

Overlooking Municipal Compliance and Certificates

The Pitfall:

A transfer cannot take place without various compliance certificates. Failure to obtain or agree on responsibility for these can cause costly delays.

Required Certificates (in most cases):

- Electrical Compliance Certificate

- Water/plumbing Certificate (Cape Town)

- Beetle Certificate (in coastal areas)

- Gas Compliance Certificate

- Rates clearance certificate from the municipality

How to Avoid Them:

- Assign responsibility for obtaining and paying for certificates in the agreement

- Begin the process early; some municipalities take weeks to issue clearance certificates

- Don’t wait until the last minute to request compliance inspections

Voetstoots Clause Misuse or Misunderstanding

The Pitfall:

The voetstoots clause means the buyer accepts the property “as is.” While still legally valid in private sales, this clause is not enforceable against consumers where the CPA applies (e.g., if the seller is a property developer or estate agent).

Common Issues:

- Sellers hiding behind the clause after the buyer discovers faults

- Buyers are unaware of their consumer rights

- Use of voetstoots even in commercial transactions involving developers

How to Avoid Them:

- Clarify whether the sale is subject to the CPA.

- Understand the limitations of voetstoots clauses.

- Always document the property’s condition at the time of sale

Ignoring Special Levies, Arrear Rates, or Hidden Costs

The Pitfall:

Buyers often find themselves liable for hidden costs like special levies in sectional title units or outstanding municipal rates and taxes.

Common Issues:

- No mention of special levies passed before transfer

- Sellers refusing to pay arrears

- Buyer assumes transfer fees cover all costs

How to Avoid Them:

- Request a levy clearance certificate and body corporate minutes

- Ask for a municipal statement from the seller showing the account is up to date

- Clarify in the agreement who pays what before transfer

Final Thoughts: Legal Review is Not Optional

Property sale agreements in South Africa is a legally binding contract with long-term financial implications. Yet many buyers and sellers use outdated templates or sign agreements drafted by unqualified individuals. This increases the risk of costly errors.

Before signing anything, have the agreement reviewed by a qualified property attorney, preferably one who knows your local municipality, zoning bylaws, and regional property norms. A small upfront investment in legal advice can prevent massive financial losses and heartache later.

Conclusion

The South African property market offers great opportunities, but navigating the legal landscape requires care. Common pitfalls in South African Property Sale Agreements , like unclear suspensive conditions, vague descriptions, or hidden costs, can derail even the most promising deals. By staying informed and involving professionals, buyers and sellers can protect their investments and ensure that the transfer process proceeds without unnecessary surprises.

If you’re planning to buy or sell property, contact AWD Law today for tailored legal support and contract review.

Kindly be advised that AWD Law does not enter into litigation on behalf of clients. Our conveyancers specialise exclusively in the development of vacant land, property transfers, bond registrations, administration of deceased estates and notarial practice. Should you require assistance with a litigation, kindly contact The Legal Practice Council.

Contact AWD Law For Professional Property Advice before signing your Offer to Purchase.

All fields marked by an asterisk are required for form submission.