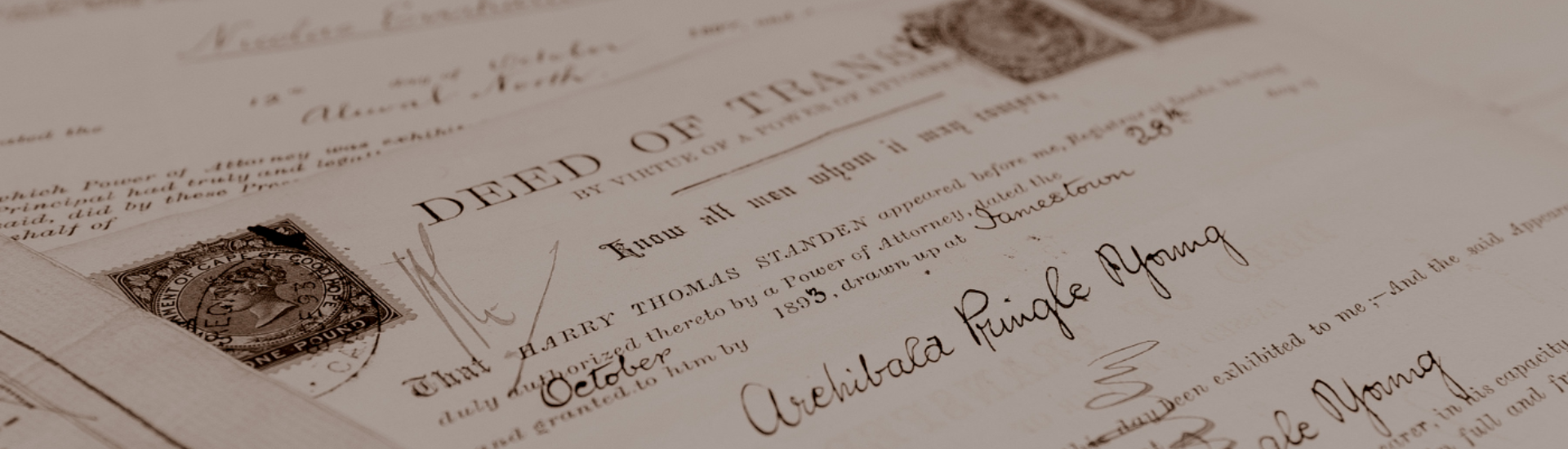

Trusts, Wills and Estates

Administering a deceased’s estate can be a complex and tedious process, which can take between 8 months

and several years to finalise, and which can lead to great frustration to all parties concerned. Therefore, it is important to ensure that a Will is in place and that an experienced Executor is appointed, who is familiar with the process and who can ease the family’s burden by administrating the estate in an efficient and responsible manner.

A General Guide To The Administration of Deceased Estates Process

- The process involved in the administration of the estate of the deceased is prescribed by the Administration of Estates Act of 1965.

- The type of appointment and reporting documentation required, are determined by the value of the estate. Where the value of the estate is less than R250 00.00, a Master’s Representative is appointed and Letters of Authority is issued, in terms of Section 18(3) of the Administration of Estates Act of 1965, which allows

the representative to administer the estate without attending to the full process in terms of the Act. - Where an estate is valued at more than R250 000, Letters of Executorship is issued and an Executor is appointed, who is obliged to follow the full process as stipulated in the Administration of Estates Act of 1965.

There is a Comprehensive Process To Winding Up An Estate.

Estate Duty is a tax levied on the estate of the deceased, at a flat rate of 20%, in accordance with the provision of the Estate Duty Act. Estate Duty is due and payable when the deceased’s net estate exceeds R3.5 million. A person’s net estate is the value of the estate after all the

permissible deductions have been deducted.

Estate Duty is due and payable 1 year after the person has passed and currently the interest levied on late payments is 6% per annum.

The Executor’s fee is calculated and based on the gross value of the deceased’s estate, including all property owned by or due to the deceased, at date of death. Thus, he is only allowed to levy his fee on the assets that form part of the estate and proceeds/balances paid to the estate.

The maximum fee which can be levied is 3,5 % on the gross value of the estate (Excluding VAT) and 6% on income accrued and collected after death, during the period of administration. If the Executor/the appointed Agent is registered as a VAT Vendor, he is entitled to charge VAT on his fee.

Any services rendered not directly pertaining to the administration of the estate shall be charged in addition. Once the distribution has been realised, the Executor must furnish the Master with proof that all

the creditors have been paid, all the heirs have received their benefit and that the estate has been liquidated.

If the Executor has complied with all the requirements, he may request a Filing sheet from the Master and if the Master is satisfied, he will issue a Filing sheet releasing the Executor of all his duties.